Rumored Buzz on Loan Apps

Wiki Article

The Only Guide for Loan Apps

Table of ContentsAbout Best Personal LoansThe Only Guide for Best Personal LoansSome Ideas on Instant Cash Advance App You Should KnowAll About Instant Cash Advance AppAll About $100 Loan Instant AppThe Ultimate Guide To Loan Apps

With a personal loan, you pay fixed-amount installments over a collection amount of time till the debt is totally paid off. Before you make an application for a personal funding, you need to recognize some usual financing terms, consisting of: This is the amount you borrow. If you apply for a personal lending of $10,000, that amount is the principal.

What Does Instant Cash Advance App Do?

APR represents "yearly portion price." When you take out any type of sort of car loan, along with the interest, the loan provider will typically charge fees for making the financing. APR incorporates both your rate of interest price and also any loan provider costs to offer you a much better image of the real price of your car loan.

The variety of months you have to pay off the lending is called the term. When a lending institution approves your personal loan application, they'll educate you of the rate of interest price and term they're supplying. Monthly during the term, you'll owe a month-to-month settlement to the lender. This settlement will include money toward paying down the principal of the amount you owe, as well as a portion of the overall rate of interest you'll owe over the life of the lending.

With a home or car finance, the actual building you're buying serves as security to the loan provider. instant loan. An individual funding is normally only backed by the great debt standing of the debtor or cosigner. However, some loan providers provide protected individual lendings, which will certainly need collateral, and also might provide better prices than an unsecured car loan.

What Does Instant Loan Mean?

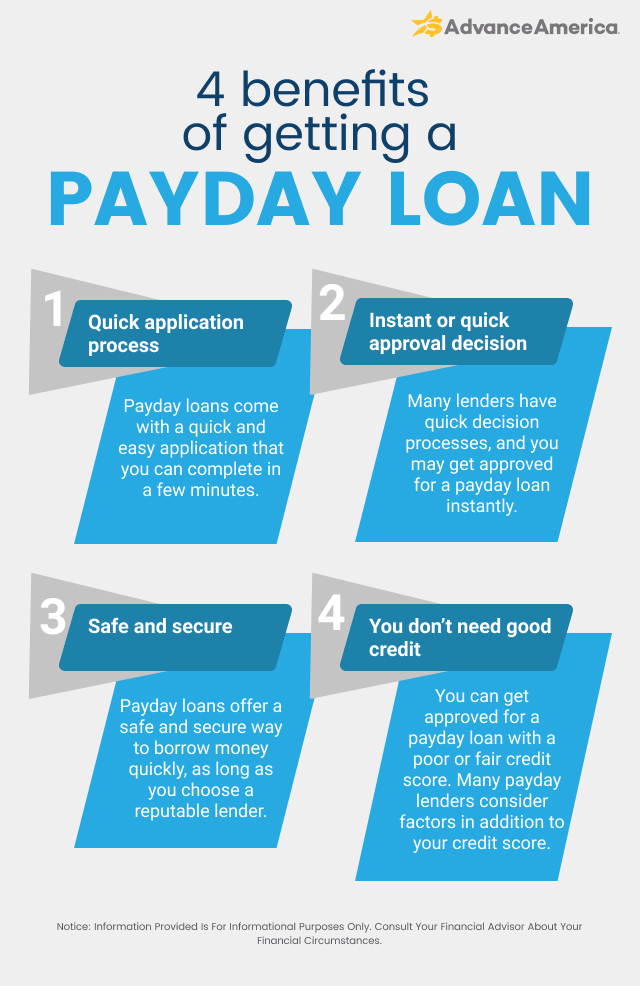

Nonetheless, in the short-term, way too many hard questions on your record can have a negative impact on your credit report. If you'll be contrast purchasing by relating to even more than one loan provider, make certain to do so in a brief time framework to decrease the effect of tough inquiries.On the bonus side, an individual finance can help you make a huge acquisition. Breaking a big expenditure right into smaller repayments over time can assist make that price more workable when you have secure revenue. Personal loans usually have rate of interest that are less than what you would certainly pay for a credit rating card purchase.

, and also mix of debt kinds. $100 loan instant app.

Everything about Loan Apps

When your business is still young as well as expanding, it is likely that you will not have enough funding to feed its development so that it can recognize its complete capacity. Such are the moments when you will intend to explore your alternatives in regards to financing. Among these options is financial institution borrowing.

Prior to you rush to the closest bank, nevertheless, it is very important that you recognize what the benefits and also drawbacks of a small business loan are. Large purchases, specifically those of properties vital to your business, will eventually be required at some point or various other. A financial institution lending can assist in such circumstances.

7 Simple Techniques For Loan Apps

Financial institutions supply a substantial benefit right here due to the fact that, without them, it would not be very easy for numerous individuals to start companies or expand them. For some, it would be downright difficult. Usually, when you take a lending from a bank, the bank does not inform you what you're mosting likely to make with that cash.These will certainly be different from one financial institution to the following and also are usually flexible, allowing you to opt for the terms that prefer you one of the most. With the capability to go shopping around from one financial institution to an additional as well as to bargain for much better terms, it's very simple to obtain a wonderful handle a small business loan.

If you get a lengthy term lending from a financial loan apps institution and also make all of your settlements on time, your credit report will certainly boost over the life of the funding. In situation you end up settling the whole lending on schedule with no missed payments, your credit rating will in fact improve.

The smart Trick of Loan Apps That Nobody is Discussing

The majority of business fundings are secured, which implies something is backing the loan. If the lending is secured by security, after that the bank can declare some possession of your own or your business in the occasion that you can not pay off the loan.Report this wiki page